For significant families

with $5-100M+ in assets

For significant families

with $5-100M+ in assets

I act for a small number of successful families and business owners. The role I play is often like sitting on the Family Board – helping you articulate where you’re trying to go, and then applying a risk management lens to chart a path forward.

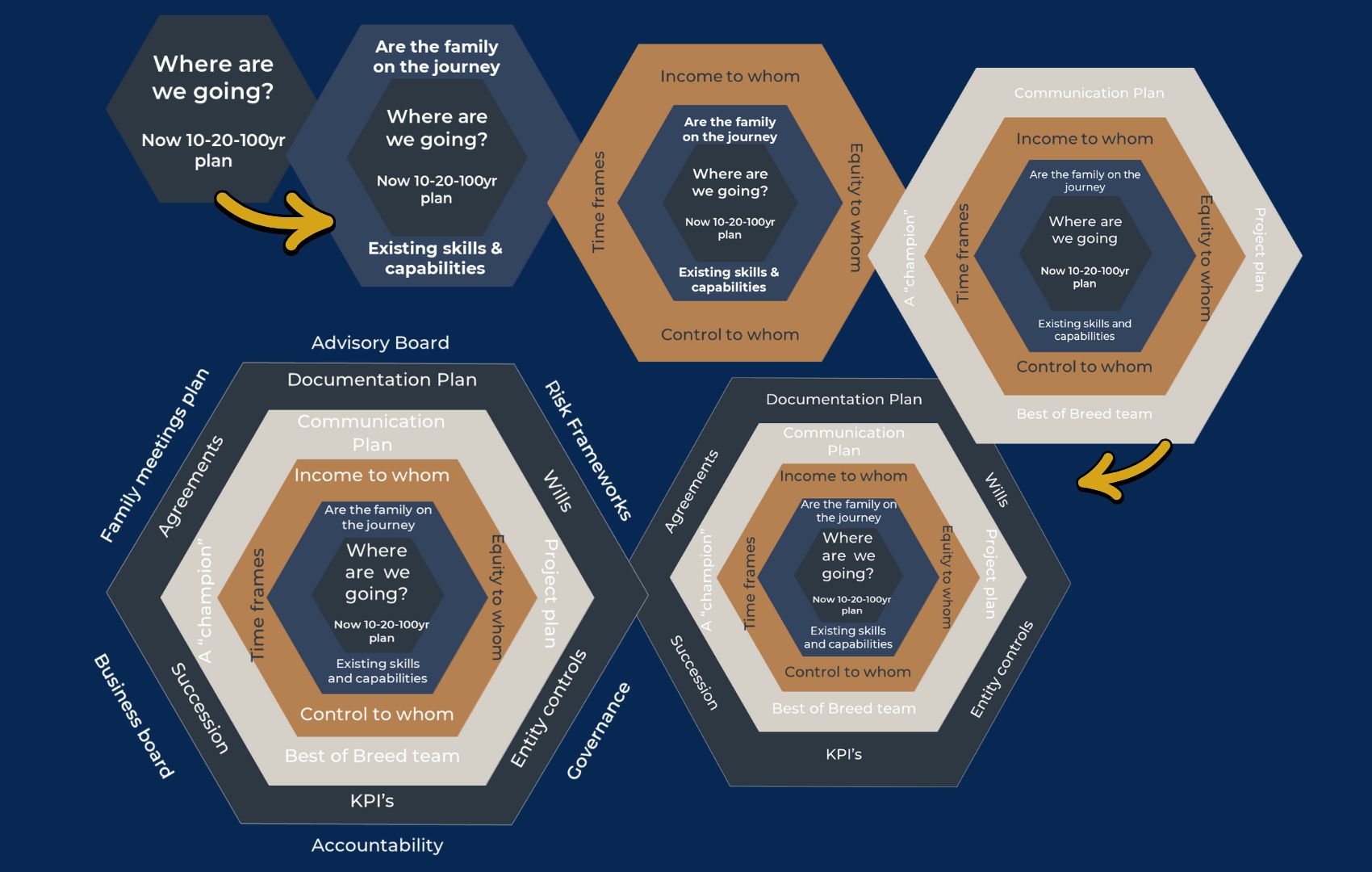

This begins with clarifying your immediate challenges and time horizon – whether that’s a 10, 20 or even 100-year plan. From there, we address the risks that may arise along the way:

Living too long, dying too early, family dynamics, or structural complexity.

I act as a sounding board, a strategic facilitator, and in some cases, as a member of the Family Board itself.

I enjoy working with engaged, vibrant clients who recognise the need for additional capability around their family affairs – and who are committed to stewarding their wealth and relationships well.

Risk Management

Risk isn’t just financial – it’s relational, reputational and structural.

Whether it’s preparing for incapacity, addressing family tension, or identifying governance blind spots, I help families see around corners and plan for continuity.

Together, we can surface potential points of failure early and build you resilient frameworks that withstand transition.

Wealth Transfer

Transferring wealth across generations requires more than a will – it requires clarity, communication and capability.

I work with families to align structures with intent, develop rising generation readiness, and navigate fairness versus equality.

We focus on income, equity and control – and ensure your plan works in the real world.

Consider the following blueprint for a significant family;

How does this blueprint compare with your current journey?

And who do you rely on to hold you accountable to successfully implementing it all?

Legacy

What will your family stand for – in 50 years, or 100?

I help families define impact beyond capital, and design legacies that endure.

This might mean philanthropy, always a great way to introduce younger family members to assessing, managing and disbursing capital before introducing them to your total assets.

On a deeper level, this may mean focusing on values-based investing, and ensuring 100% of your capital is invested in alignment with your families values.

It may simply mean preparing the next generation to steward what’s already been built.

When we consider your personal version of legacy, and what your other family members want out of their future, it gives us a broad context to consider.

Then, with consistent attention, we can change the course of industries, states and nations.

Has your family clearly agreed on where you're heading,

or is everyone assuming something different?