For founders & fund managers

seeking capital with intent.

For founders & fund managers

seeking capital with intent.

Whether you’re raising for a business or a fund, I provide experienced, insight-led guidance and support – helping you position with the right investors, networks and messaging to accelerate traction and avoid wasted time.

If our values align and your project carries national relevance and meaningful impact, I may work with you every step of the way – from shaping your story and refining your investor materials, to standing beside you at roadshows and negotiating term sheets in the room. A true champion of your endeavour.

Either way, I’m happy to offer a sharp initial assessment and trusted direction.

the multi-facets of our business, our clients, and our impact DNA.

Mindset

Investor Relations and Capital Raising is hard – and generally, equity should be your last resort.

Most businesses are better served by fixing their fundamentals and securing forward sales contracts with their True Economic Buyer – the person or organisation most aligned with the value your company creates in the world.

These buyers don’t just fund you – they leverage what you offer, often creating multiplier effects that typical investors can’t.

In a noisy market, clarity, positioning, and timing are everything.

Remember, you don’t get money from investors until you don’t need it – meaning your proposition is de-risked. So don’t bet your survival on it!

Raising

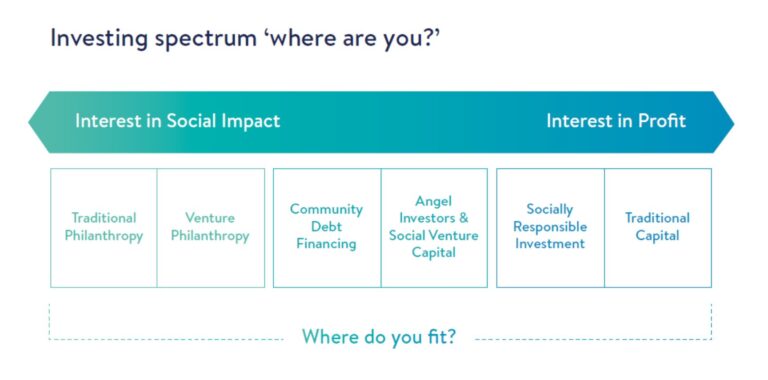

Across the capital spectrum – from grants and philanthropy to venture and institutional capital – interest, cheque sizes, and risk appetites vary enormously. Too many founders waste time pitching the wrong propositions to the wrong people.

Here’s the kind of clarity I can bring in our first session;

I will orient you on the spectrum to save time, avoid mismatch, and position with clarity.

We can then introduce you to relevant individuals, organisations and networks:

I’ve worked directly with many of the organisations above – not just adjacent to them.

Bringing me in early will save you months of wasted effort

and thousands in misaligned advisor fees.

Acquisition & Exit Strategy

If you’re planning to sell – now or in the future – it’s a valuable idea to start by identifying your most likely acquirers and working backwards.

Your business needs to be structured, positioned, and performing in a way that makes it a compelling opportunity – especially to those who see its strategic value.

I will help you prepare not just to exit, but to exit well – to the right buyer, with the right outcome, on your terms.